Arthur John Cockfield IV – 1967-2022

The Queen’s Law community is remembering Professor Art Cockfield, one of the world’s leading tax law scholars, and a highly esteemed and cherished teacher, mentor, colleague, and friend. He died unexpectedly on January 9 from an unsuspected heart condition. He was 54.

“Art Cockfield has left an indelible imprint on laws and policies in Canada and around the world, as well as on the Queen’s Law community members near and far who’ve known him from student to professor,” says Dean Mark Walters. “His work on comparative and international tax law was truly innovative and extremely influential. He was a mainstay of our law school, a loyal and dedicated teacher who cared deeply for his students, and a cherished mentor and friend to so many of us.”

To celebrate the life, work, and contributions of Arthur John Cockfield IV, a collection of his close colleagues, students, and fellow alumni share their reflections on his enduring influence and legacy.

In September 1990, the Ottawa native arrived on Queen’s campus fresh from earning his undergraduate degree from Western’s Ivey School of Business and eager to begin his LLB studies. Among the classmates he would become lifelong friends with was Frank Walwyn. “Art blended into every circle of law students effortlessly,” recalls Walwyn, now a partner with WeirFoulds LLP in Toronto. “He was gifted with a personality that allowed him to approach anyone and speak with them and make them feel included.”

Cockfield applied his natural affability and sense of collegiately to his burgeoning legal studies. “It was only when you engaged with Art substantively on legal issues that you grasped the depth of his intellect,” Walwyn recalls, noting that his friend was careful not to use it to diminish anyone. “Even in heated law student discussions about legal issues, Art was adept at teaching us the answer without it feeling as though he was lecturing us.”

Another formative part of Cockfield’s education was his extensive involvement with Queen’s Legal Aid (QLA) as a student caseworker and group leader. His supervisor, Merrilees Muir, Law’84, remembers him as “clearly a standout among an extremely talented group.

“Even then, Art’s confidence, knowledge, diligence, and intellect were on full display, along with a dedication to the principles of social justice,” continues Muir, who later became Law Faculty Registrar. “That time was also memorable for the great camaraderie and fun within the group, with Art leading the way on that front as well. He had so many gifts, both personally and intellectually, and generously shared them then, as he continued to do throughout his most distinguished career.”

The direction of that career is something Cockfield discussed with one of his teachers, Professor Nick Bala, Law’77, who taught him Contracts and Family Law, and encouraged him to pursue legal academia. “Art was a very engaged, thoughtful student and, although interested in the practice of law, he wanted to be a law professor right from the start,” recalls Bala.

But before submitting his grad school applications, Cockfield spent time in the private sector at Goodmans LLP in Toronto, articling and then practising for a year. His next stop was California’s Stanford University for JSM and JSD degrees. Following graduation in 1998, he was appointed an assistant professor at San Diego’s Thomas Jefferson School of Law, where his junior academic career flourished in tax law and the emerging cyber security law and policy field. In 2001, Cockfield returned to his LLB alma mater, appointed Queen’s National Scholar in Taxation.

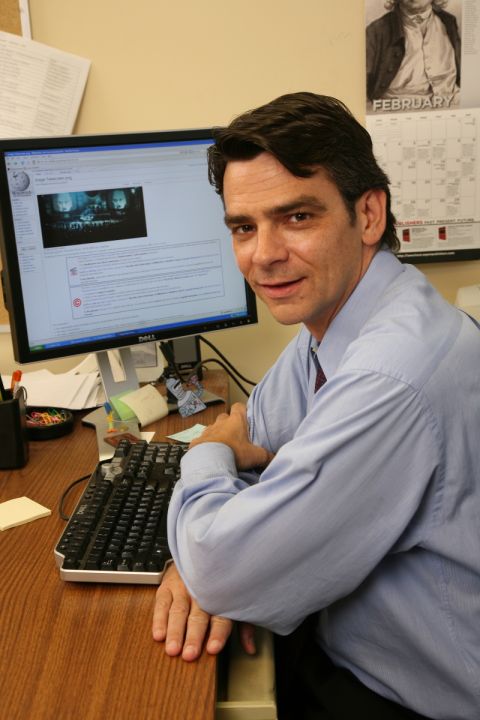

Over the next two decades, Cockfield solidified his position as a pre-eminent authority on tax law, financial crime, e-commerce, privacy, and legal ethics. He received research grants totaling more than $6 million, most from Canada’s Social Sciences and Humanities Research Council (SSHRC), including his first one as a member of Queen’s Surveillance Studies Centre. His 14 books, 80-some articles and book chapters were met with wide interest and acclaim. One of the most highly referenced tax law scholars in the world (with about 1,400 journal citations listed in Google Scholar), his work was often cited by the Supreme Court of Canada (including 14 times in 2021 alone). He became known to the general public as a distinguished subject expert in his field through numerous newspaper columns, featured articles, and a novel, The End.

The Canadian Government, the World Bank, and several other public and private sector stakeholders frequently sought him out to consult on such issues as combatting international tax evasion and other forms of cross-border financial crime. Particularly notable was his consultancy to the International Consortium of Investigative Journalists (ICIJ) in 2013 regarding tax haven data leaks that would explode into the Panama Papers.

By the time cross-border tax lawyer Sunita Doobay, Law’92, connected with her would-be longtime friend in 2007, “Art was already a fixture in the tax world.” Among his seminal publications was the co-authored book International Taxation in Canada (LexisNexis, 2006, 4th ed. 2018). Canada’s Supreme Court, calling Cockfield a “learned author,” would cite it 13 times in Canada v. Alta Energy Luxembourg SARL, its 2021 decision so eagerly anticipated by the international tax community worldwide.

“In my opinion, Art was Canada’s leading tax authority on the information exchange between tax authorities under the common reporting standards and on the protection of the taxpayer’s privacy rights – a crucial area of modern tax law,” says Doobay, now a partner with Blaney McMurtry LLP in Toronto.

“Art was ahead of most of us in the tax law community,” she adds, noting his foresight into the role the OECD (Organisation for Economic Co-operation and Development) would play in e-commerce taxation, as described in his 2006 Yale Journal of Law and Technology article. “It was not until December 20, 2021, that the OECD finally released the pillar two model rules for the 15 per cent minimum tax to be levied on multinational enterprises,” Doobay notes. “Who else in 2006 could have thought that the developed world would depend on the OECD for guidance in digital taxation of ecommerce?”

Even while Cockfield’s focus was on privacy and digital tax, he continued delving into other areas of tax law, including rectification. For the article “Rectifying Tax Mistakes versus Retroactive Taxes: Reconciling Competing Visions of the Rule of Law” (Canadian Tax Journal, 2013), he and co-author Professor Catherine Brown received the Canadian Tax Foundation’s award for the best article of the year.

Brown, a Fulbright Fellow at University of Calgary’s law school, recalls being intrigued by Cockfield’s work after reading his book, NAFTA Tax Law and Policy: Resolving the Clash between Economic and Sovereignty Interests (U of T Press, 2005). “My first thought was, ‘Finally, there is someone I can talk to about tax and trade law issues’.”

Cockfield and Brown also teamed up to co-author and co-edit other much-read books and chapters. “Art was a creative, innovative, very original and provocative thinker,” she says. “As a research collaborator, he was reliable, unconventional, and ridiculously fun. His work was clearly stamped with the meticulous, refreshing, and interdisciplinary research for which he was so well respected.”

He remained active in his school the whole time, too, notably serving two terms as an Associate Dean, hosting the world’s first virtual reality international law conference in 2010 to commemorate Professor Hugh Lawford, and mentoring junior faculty. “Art was a wonderful and very collegial colleague,” says Bala, “and a very well-regarded teacher who consistently scored very high in teaching evaluations.”

That excellence in teaching is something to which former students like Mark Cavdar, Law’13, have attested. “Professor Cockfield was a natural communicator, injecting everything he taught with his distinctive voice and humour,” says Cavdar. “What made him unique for me was his candor, his utmost respect for and deference to the foundations of our common law, and his ability to dialogue with a room of aspiring lawyers in a language that they inherently understood.”

He also showed his students what a well-rounded life as a lawyer could and should be, says Cavdar, now Vice President of Business Development with Nova Cannabis Inc. in Toronto. “Professor Cockfield was the first to encourage us to jump into the Queen’s community with both feet,” he recalls. “Almost a decade after graduation, what I remember most is the camaraderie and community I built with his encouragement by prioritizing my colleagues and contemporaries at the law school, leaning into my interests, passions, and finding and fostering a community of like-minded friends.

“Art was impossibly humble for someone so accomplished, and never once lost the passions that powered him. That’s the enduring life lesson I will carry forward: success does not have to come at the cost of your passions.”

Tyra Yah, Law’20, currently articling with Rosen Kirshen Tax Law in Toronto, appreciated Cockfield’s “facilitator” teaching style and mentorship. “He would ask us to problem solve and apply what we learnt in class to our own lives,” she recalls. “I didn’t know I had so many opinions on tax law and policy until I enrolled in his class!

“He was incredible at balancing encouragement and deserved praise with honest, straightforward feedback about the quality of our work,” she adds. “His good humour and genuine desire to see us improve our legal skills created a safe space where we could explore ideas and concepts, safe from judgement. By doing so, he encouraged our creative thinking and self-discernment.”

After reading one of Yah’s tax law research papers, Cockfield encouraged her to turn it into an article and then guided her in vetting her ideas. Their co-authored op-ed, “How should the government tax social media influencers?” was published in the Toronto Star in 2020. “He was always looking for ways to put his students first and expose us to opportunities for academic or career growth,” she says. “He really went above and beyond to ensure that our projects were successful.”

PhD candidate Kasia McNaughton, who recently began planning her upcoming thesis defense with Cockfield, had chosen him as her supervisor for two reasons. First was his expertise in financial crime, she says – “his inter-disciplinary approach to money laundering and his search for the best legal and policy tools to tackle financial crimes and change this world into a better one.” Second was his simple and coherent writing style. “He was the highest quality scholar who writes to tell his audience a story and not just to impress them with his knowledge. I wanted to learn how to write like this!”

As a graduate supervisor, McNaughton says, “Art was fully on board with you, trusting you and empowering you, but at the same time keeping you realistic.”

He also trusted her with leading a team of student researchers for “Invisible Underworld: Inhibiting Global Financial Crime,” a five-year project for which he and research partner Professor Christian Leuprecht of RMC and Queen’s Political Science received a $153,000 SSHRC research grant in 2019. After typical meetings with him, she says, “You felt like you’d just had a cup of coffee with your best friend; you would sit down at your desk to write down what you had discussed, and that was when you realized that Art had just helped you solve your problem! He listened and was genuinely interested in what you thought.”

Colleagues, alumni, friends, and family have come together to establish the Professor Arthur Cockfield Memorial Award in Law, which will provide support for Queen’s Law students with demonstrated financial need and academic achievement. Contributions may be made online.

Among Professor Cockfield’s surviving family members are his three sons: Arthur (Com’18), Jack, and William.

Those wishing to share memories of Professor Cockfield with his family and/or the Queen’s Law community may do so online. His obituary is posted on the Arbor Memorial website.

Plans are under way for a Celebration of Cockfield’s Life and Work and details will be provided in coming weeks on the Queen’s Law website.

BY LISA GRAHAM